All Categories

Featured

Table of Contents

There is no payout if the plan expires before your fatality or you live beyond the plan term. You might have the ability to restore a term policy at expiration, yet the premiums will be recalculated based on your age at the time of revival. Term life insurance policy is generally the least pricey life insurance policy offered because it uses a fatality advantage for a restricted time and does not have a cash value element like long-term insurance policy.

At age 50, the costs would certainly rise to $67 a month. Term Life Insurance policy Fees thirty years old $18 $15 40 years old $28 $23 half a century old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in superb health and wellness. On the other hand, here's a look at prices for a $100,000 whole life plan (which is a sort of permanent policy, implying it lasts your life time and consists of cash value).

Lenders That Accept Term Life Insurance As Collateral

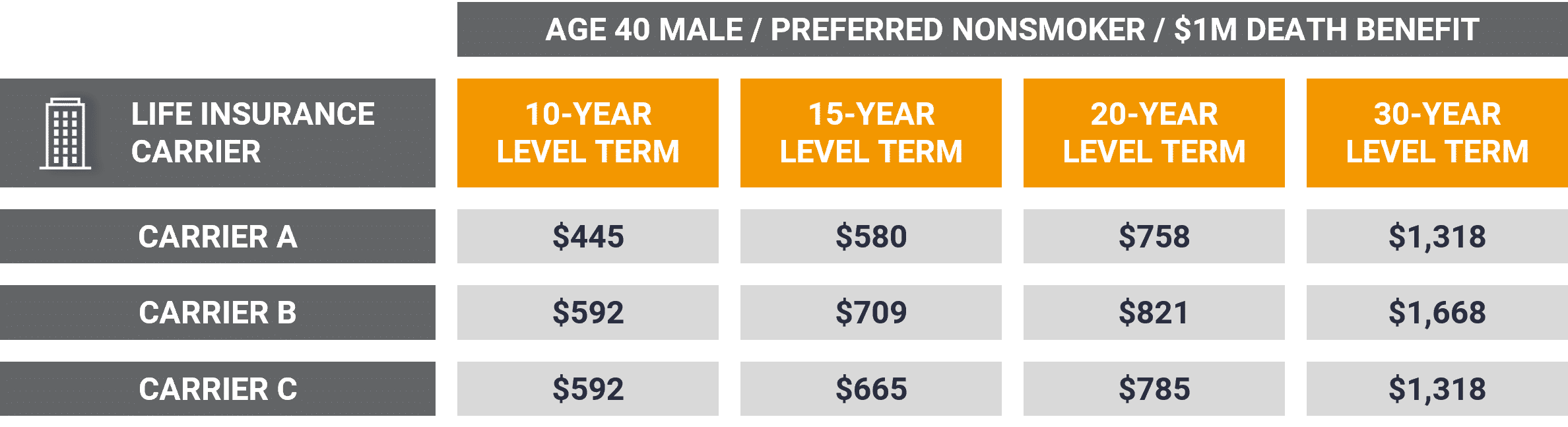

The decreased danger is one element that enables insurance firms to bill lower premiums. Rates of interest, the financials of the insurer, and state laws can also influence costs. Generally, business often offer better rates at the "breakpoint" protection levels of $100,000, $250,000, $500,000, and $1,000,000. When you take into consideration the quantity of coverage you can obtain for your costs bucks, term life insurance policy tends to be the least costly life insurance policy.

Thirty-year-old George wishes to shield his family in the not likely occasion of his early death. He buys a 10-year, $500,000 term life insurance policy policy with a costs of $50 per month. If George dies within the 10-year term, the plan will pay George's recipient $500,000. If he dies after the plan has actually run out, his beneficiary will receive no advantage.

If George is detected with an incurable ailment during the very first policy term, he most likely will not be qualified to renew the plan when it ends. Some policies use ensured re-insurability (without evidence of insurability), but such attributes come with a higher expense. There are several sorts of term life insurance.

Usually, many business offer terms varying from 10 to 30 years, although a few deal 35- and 40-year terms. Level-premium insurance policy (life insurance 10 year term meaning) has a set month-to-month repayment for the life of the plan. A lot of term life insurance policy has a level premium, and it's the kind we have actually been describing in a lot of this write-up.

The Term “Illustration” In A Life Insurance Policy Refers To

Term life insurance coverage is appealing to young individuals with kids. Parents can acquire considerable coverage for an inexpensive, and if the insured passes away while the policy holds, the family can rely on the fatality benefit to replace lost earnings. These policies are also appropriate for individuals with growing family members.

Term life plans are excellent for people that desire substantial coverage at a reduced price. People who own whole life insurance pay a lot more in premiums for much less protection however have the safety of recognizing they are secured for life.

The conversion motorcyclist ought to enable you to transform to any long-term plan the insurance coverage firm supplies without constraints - what does a 20 year term life insurance mean. The key functions of the cyclist are maintaining the original wellness ranking of the term plan upon conversion (also if you later on have wellness concerns or become uninsurable) and making a decision when and just how much of the coverage to transform

Certainly, general premiums will certainly raise considerably considering that entire life insurance policy is extra pricey than term life insurance policy. The advantage is the assured authorization without a medical examination. Clinical problems that develop during the term life duration can not create costs to be increased. However, the business may need restricted or full underwriting if you intend to add additional cyclists to the brand-new plan, such as a long-term care rider.

Term life insurance policy is a reasonably economical means to give a swelling amount to your dependents if something takes place to you. It can be an excellent choice if you are young and healthy and balanced and sustain a family members. Entire life insurance comes with substantially higher regular monthly premiums. It is indicated to supply protection for as lengthy as you live.

What Is A Child Rider On Term Life Insurance

It depends on their age. Insurer established an optimum age restriction for term life insurance policy plans. This is generally 80 to 90 years old but might be greater or reduced relying on the company. The premium additionally increases with age, so an individual aged 60 or 70 will pay substantially greater than somebody years younger.

Term life is somewhat comparable to vehicle insurance policy. It's statistically not likely that you'll need it, and the costs are money away if you don't. If the worst happens, your household will get the advantages.

This plan style is for the consumer that needs life insurance policy but would certainly like to have the ability to pick just how their cash value is spent. Variable plans are financed by National Life and distributed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Coverage Company, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor information, go to Irreversible life insurance policy develops cash worth that can be borrowed. Plan lendings build up passion and unsettled plan fundings and passion will decrease the survivor benefit and cash money value of the plan. The quantity of cash value available will typically depend upon the kind of irreversible policy bought, the quantity of coverage bought, the size of time the plan has been in force and any exceptional policy financings.

What Is Optional Term Life Insurance

Disclosures This is a basic description of protection. A total statement of coverage is found only in the policy. For more details on insurance coverage, costs, restrictions, and renewability, or to apply for protection, call your neighborhood State Farm agent. Insurance plan and/or associated motorcyclists and features may not be offered in all states, and plan terms and problems may differ by state.

The major differences in between the different kinds of term life policies on the marketplace concern the size of the term and the insurance coverage amount they offer.Level term life insurance policy features both degree costs and a degree death advantage, which means they stay the same throughout the period of the policy.

It can be renewed on an annual basis, however premiums will certainly enhance every single time you renew the policy.Increasing term life insurance policy, likewise known as an incremental term life insurance policy strategy, is a plan that features a fatality advantage that raises over time. It's usually more intricate and costly than degree term.Decreasing term life insurance policy features a payout that decreases with time. Common life insurance policy term sizes Term life insurance policy is cost effective.

The main distinctions between term life and whole life are: The size of your coverage: Term life lasts for a collection duration of time and after that ends. Ordinary regular monthly whole life insurance price is calculated for non-smokers in a Preferred health classification, getting an entire life insurance plan paid up at age 100 provided by Policygenius from MassMutual. Aflac offers many long-term life insurance plans, consisting of entire life insurance policy, last expense insurance coverage, and term life insurance policy.

Latest Posts

Flexible Term Life Insurance

$25,000 Term Life Insurance Policy

Burial Mutual Of Omaha